Strengthened International Development Strategy Flexible Capacity Allocation at Home and Overseas in Response to Changes in Macro Environment

(Hong Kong, 31 July 2024) ― Xinyi Glass Holdings Limited (“Xinyi Glass” or the “Group”) (stock code 00868), a leading integrated automobile glass, energy-saving architectural glass and high-quality float glass manufacturer, today announced its unaudited interim results for the six months ended 30 June 2024 (the “Period Under Review”).

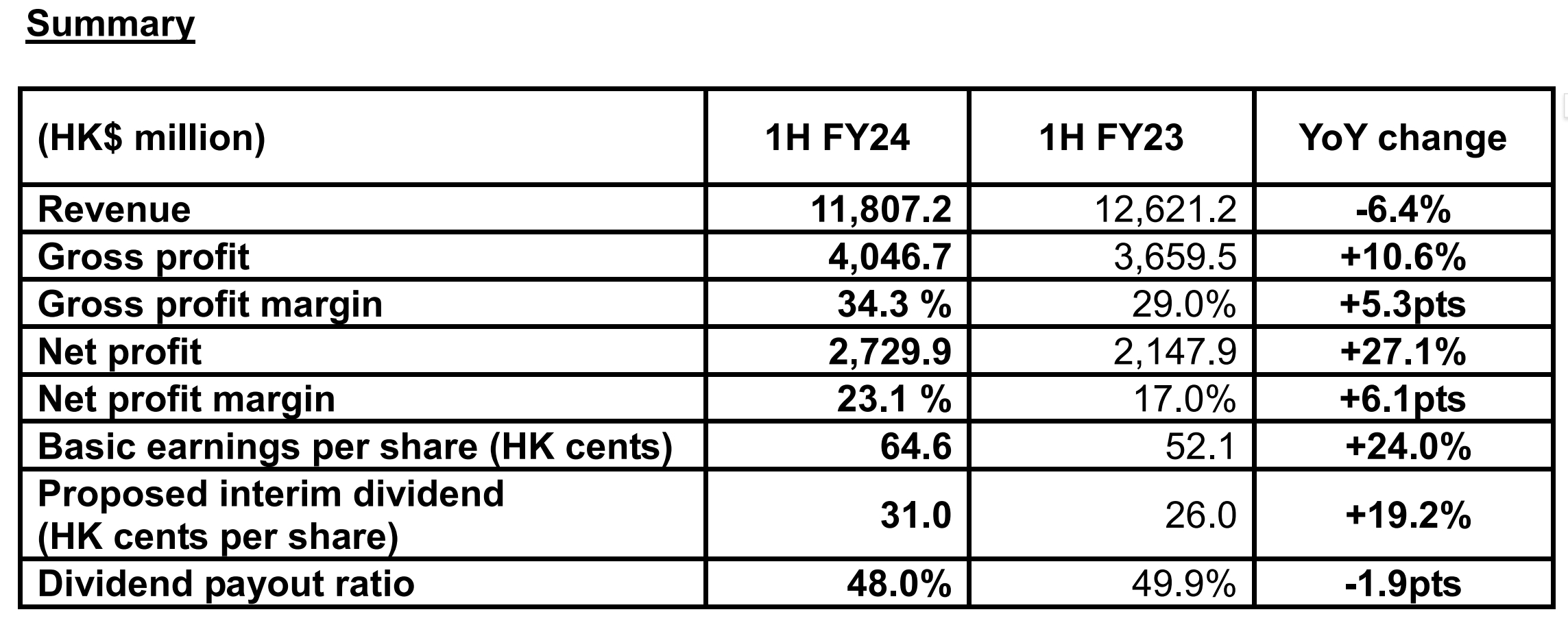

The Group’s differentiated product portfolios have higher added value, which help to maintain competitiveness of its average selling prices. Together with steady growth of automobile glass, the Group has demonstrated strong resistance to external headwinds. In the first half of 2024, although demand from downstream industries declined, the Group boosted its gross profit and net profit through effective cost control measures. During the Period Under Review, the Group recorded revenue of HK$11,807.2 million, a slight decrease of 6.4 % year-on-year. However, gross profit surged by 10.6 % year-on-year to HK$4,046.7 million and gross profit margin climbed by 5.3 percentage points to 34.3 % (1H FY23: 29.0%). Net profit for the Period Under Review was HK$2,729.9 million, up 27.1 % year-on-year, and net profit margin increased to 23.1 % (1H FY23: 17.0%). Basic earnings per share were HK 64.6 cents (1H FY23: HK 52.1 cents per share).

The Group’s financial position remained sound, with bank borrowings further reduced by 13.1 % from the end of 2023, and the net debt gearing ratio remained at a healthy level of only 15.2 %. The Board of Directors declared an interim dividend of HK 31.0 cents per share (1H FY23: HK 26.0 cents), representing a dividend payout ratio of 48.0%.

Business Review

Automobile glass

Architectural glass

Despite the sluggish real estate industry, the Group established a solid and reliable target customer base, which stabilized its revenue at HK$1,561.0 million for the Period Under Review, a slight decrease of 2.8 % year-on-year. Gross profit decreased by 11.0% year-onyear to HK$444.2 million, with a gross profit margin of 28.5 % (1H FY23: 31.1%). China’s green construction development plan has stimulated the demand for single insulation, double insulation (triple layer) and laminated insulation (triple layer) glass products. The supply and demand of construction projects are expected to be continuously optimized, and creating room for business improvement.

Prospects

The current global economic and political landscape is turbulent. In this complex and volatile macro environment, the Group expects the industry outlook to remain challenging. However, with its high-end and high-quality product positioning, differentiated product portfolios and international production capacity and business layout, Xinyi Glass is confident that it can withstand the potential pressure of different industry cycles. The Group will continue to ease the pressure on glass costs through diversified and effective procurement channels and economies of scale, which will help to increase the profit margins of the three major businesses. Overseas demand for glass products is stable, so the Group's overseas sales mix will increase accordingly. Currently, the sales of differentiated products account for about 47% of the Group’s float glass products. The Group will continue to deepen the operating strategies of a differentiated product mix, such as expanding the portfolio of high valueadded products, including special glass, and increasing the proportion of these products in total sales, in order to improve the overall gross profit margin of the products.

At the same time, Xinyi Glass will maintain the production capacity of its strategically located industrial complexes in Mainland China to ensure flexibility and competitiveness in production planning. It will also actively and orderly expand overseas production, diversify its market layout, and enhance its risk resistance. The Group is building two new production lines in JIIPE, Surabaya, Indonesia, and the first production line is expected to be put into operation in end of this year. The Indonesian industrial complex will also undertake automobile glass and architectural glass projects, which will help expand its market share in Indonesia and surrounding markets and further optimize the supply structure of overseas products. Together with two production lines with a total daily capacity of 1,400 tons in Chongqing, which were acquired in June last year, and two production lines in Heshan, Guangdong, which started operation in the first half of the year, the Group’s total annual float glass melting capacity will increase to 9.15 million tons.

Dr. LEEconcluded, "In its more than 30 years of history, the Group has seen opportunities and overcome difficulties. We have always adhered to our belief in and strategy of being proactive, innovative and grounded, which has enabled us to make steady progress and achieve continuous breakthroughs. Looking ahead, policies favorable to the real estate industry will be gradually introduced and implemented, which is expected to improve market sentiment and consolidate demand for glass products. The supply-demand balance is expected to remain stable. Xinyi Glass will continue to utilize the world's leading production equipment to produce high-quality and differentiated products to meet the specific needs of high-end customers, maximize shareholder value and accelerate its growth into a leading global brand."